On Friday, the oft-maligned Redmond,WA software behemoth, Microsoft Corp., leapfrogged Exxon to become the second-most valuable company in the world behind guess who? Apple, of course. Microsoft’s stock has increased more than 30 percent in the last year as the company has undergone a series of changes under new CEO Satya Nadella. Microsoft saw its market value increase to around $410 billion, while Exxon Mobil, the former #2 now has a market cap of about $400 billion.

Microsoft regains #2 ranking of most valuable companies in the world

Still, both Microsoft and Exxon lag behind Apple’s market cap of about $662 billion. The other big tech companies are also doing well with Google valued at about $374 billion; Facebook at $208 billion; and Amazon at $149 billion. Financial stuff really doesn’t interest me all that much so I didn’t bother researching to see what the top 5 companies were back just 25 years ago in 1989. I know one thing – there was no Google, Facebook or Amazon. What an incredible change has taken place.

Apple is #1 thanks to the genius of Steve Jobs

When Apple surpassed Exxon-Mobil as the world’s most valuable company in August 2012, it caused a debate over what, precisely, “most valuable” means and what part inflation plays in it. Apple topped out at $661 billion U.S., the highest absolute-value figure in history, but it seems it has a ways to go before it can claim the inflation adjusted top-prize. Here are just 5 examples of companies that have exceeded Apple by large measure when adjusted for inflation:

1. The Dutch East India Company in 1637 - Adjusted to 2012 $7.4 trillion

HOW IT GOT SO BIG: Founded in 1602, the world’s first publicly traded company on the world’s first stock exchange started off as a spice trader. Its competitive edge: The largest fleet shipping goods between Europe and Asia. In the 17th century, it grew tremendously thanks to rampant speculation on the value of tulip bulbs.

2. The Mississippi Company in 1720 - Adjusted to 2012 dollars: U.S. $6 trillion

HOW IT GOT SO BIG: The Mississippi Company was founded in 1684 to facilitate trade with the then-New World. By 1717, it was foundering, and was bought up by John Law, controller of the French National Bank, who renamed it the Compagnie d’Occident and refocused it on monopolizing trade with emerging French colonies in Louisiana.

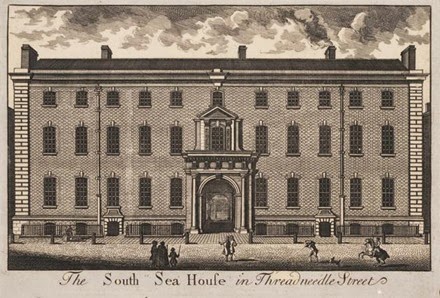

3. The South Sea Company in 1720 - Adjusted to 2012 dollars: U.S. $4 trillion

HOW IT GOT SO BIG: The South Sea Company’s history largely aligned with that of the Mississippi Company. It, too, saw hyperinflation of its share price on misplaced speculation over future business growth. But there was a difference: the British government was pulling the strings instead of the French.

5. IBM in 1967 - Adjusted to 2012 dollars: U.S. $1.3 trillion

HOW IT GOT SO BIG: The company’s early focus on research and development allowed it to bring new technologies to market before its competitors. An extensive and standards-setting sales force helped IBM build deep and lasting relationships with business and government. It developed SABRE, the first successful airline reservation system, for American Airlines. IBM too, has re-invented itself and remains in the top 5 of the world’s most valuable companies.

I wonder how Apple, Microsoft, IBM, Google, Facebook, Amazon and Yahoo will all look a 100, 200, 300 years from now? If I had to bet right now, and looking ahead just 100 years, my money would be on IBM and Microsoft. What about you?

Thanks for visiting!

Không có nhận xét nào:

Đăng nhận xét